Best Health Insurance in Madurai: A Comprehensive Guide by EngageXperts Insurance Agency

Discover the best health insurance plans in Madurai with EngageXperts Insurance Agency. Explore tailored solutions for individuals, families, senior citizens, and more. Compare quotes from top insurers, learn about claim processes, cashless hospital networks, and holistic care coverage. Contact us to secure your future today!

HEALTH INSURANCE

Health insurance is your financial safety net against unforeseen medical expenses. In Madurai, finding the right plan is especially critical due to the city's unique healthcare needs. EngageXperts Insurance Agency stands out as a trusted local partner offering tailored solutions for individuals, families, senior citizens, and more. Let's dive into everything you need to know about choosing the best health insurance in Madurai.

Why is Health Insurance Important in Madurai?

Madurai’s growing healthcare demands and escalating medical costs make health insurance essential. It provides:

Financial Protection: Covers hospitalization expenses and treatments.

Access to Quality Care: Supports cashless services in top hospitals.

Peace of Mind: Ensures you're prepared for health emergencies.

Poll: What’s your primary reason for purchasing health insurance?

Financial security

Access to better healthcare

Coverage for pre-existing conditions

Peace of mind

Why Choose EngageXperts Insurance Agency?

EngageXperts is Madurai's go-to agency for comprehensive and personalized insurance plans. Here's why:

Wide Range of Offerings: Health, life, and general insurance.

Tailored Solutions: Plans for diabetic patients, senior citizens, and more.

Competitive Premiums: Affordable options for every budget.

Seamless Claim Assistance: Support from start to finish.

Explore our specialized blog on health insurance for more insights.

Did You Know?

Fact: 70% of healthcare expenses in India are paid out of pocket. Health insurance can significantly reduce this burden while ensuring quality care.

Steps to Choose the Best Health Insurance Plan in Madurai

Identify Your Needs: Decide whether you need individual or family coverage and look for plans catering to pre-existing conditions or senior citizens.

Compare Policies: Use EngageXperts' comparison tool to evaluate plans based on premium costs, coverage, and additional benefits.

Check Network Hospitals: Choose insurers with strong cashless hospital networks in Madurai.

Understand Policy Terms: Read the fine print to know what’s covered and what isn’t.

Take Expert Advice: EngageXperts provides personalized recommendations to suit your needs.

Quiz: Which health insurance plan is right for you? Answer 5 quick questions to find out!

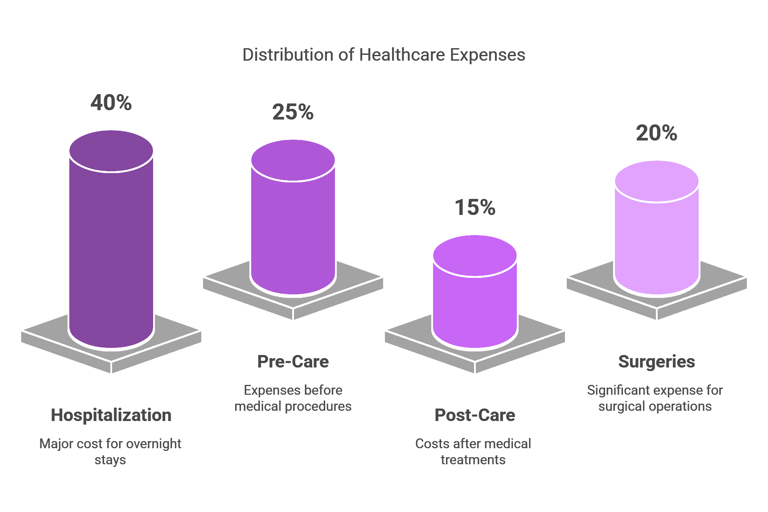

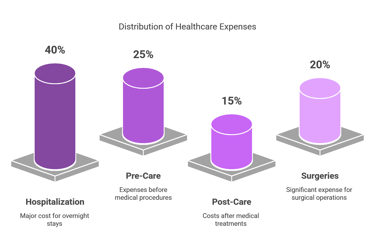

Common Expenses in Health Care

Understanding the breakdown of common healthcare expenses can help illustrate the necessity of health insurance. Below is a pie chart representation of these expenses:

Hospitalization: 40%

Pre-Care: 25%

Post-Care: 15%

Surgeries: 20%

Key Benefits of Health Insurance

Financial Safety

Health insurance provides a safety net against unexpected medical expenses. With coverage, individuals can avoid crippling debt from hospital bills and other healthcare costs.

Peace of Mind

Having health insurance allows individuals to focus on their health and well-being without the constant worry of financial strain. Knowing that medical expenses are covered can significantly reduce stress.

Access to Quality Care

Health insurance ensures access to a network of healthcare providers and facilities, allowing individuals to receive timely and quality medical care when needed.

EngageXperts’ Role

EngageXperts insurance agency plays a vital role in facilitating access to various insurance solutions, including health, life, and vehicle insurance. By offering tailored plans and expert guidance, EngageXperts helps individuals and families secure the coverage they need to protect their health and financial future.

Top Health Insurance Companies in Madurai

EngageXperts partners with leading insurance providers to bring you the best options:

Star Health and Allied Insurance

HDFC ERGO Health Insurance

Care Health Insurance

Bharti AXA General Insurance

United India Insurance

TATA AIG Health Insurance

Apollo Munich Health Insurance

New India Assurance

ICICI Lombard Health Insurance

Oriental Insurance

How to Claim Health Insurance

Cashless Claims:

Visit a network hospital.

Inform the TPA or insurer.

Submit a pre-authorization form.

Reimbursement Claims:

Collect bills and submit documents to the insurer.

Receive reimbursement for approved claims.

For official guidelines on health insurance claims, refer to the IRDAI website for credible and authoritative information.

Ready to Choose Your Plan?

Let EngageXperts Guide You!

From comparing quotes to hassle-free claim assistance, EngageXperts simplifies your health insurance journey. Contact us today at support@engagexperts.in or WhatsApp 8489613243 to get started. Explore more about our offerings in our detailed blog on health insurance in Madurai.